FAQs

What is the CSSCU?

The Commonwealth Secretariat Staff Credit Union (CSSCU) is a savings and loans co-operative for present and former staff members of the Commonwealth Secretariat.

The CSSCU was established over 30 years ago in 1987, helped by a generous donation from the then Secretary-General, Sir Shridath Ramphal. Over the years, the Credit Union has recorded steady progress in its services and business, and today (2019), its total assets are well in excess of £1 million.

The Credit Union was set up under the Industrial and Provident Societies Act 1965 and the Credit Unions Act 1979 and is regulated by the Financial Services Act. It is collectively owned by its members, all of whom are shareholders.

What are the benefits of membership?

The benefits of being a member of our Credit Union are immense. Some of these benefits are outlined below;

- Simple and flexible savings facilities, through monthly payroll deductions.

- Loans at low interest and with no security requirements.

- Simple repayment facilities arranged through the payroll.

- Speedy response to loan applications and share withdrawals.

- Profit-sharing through payment of annual dividend.

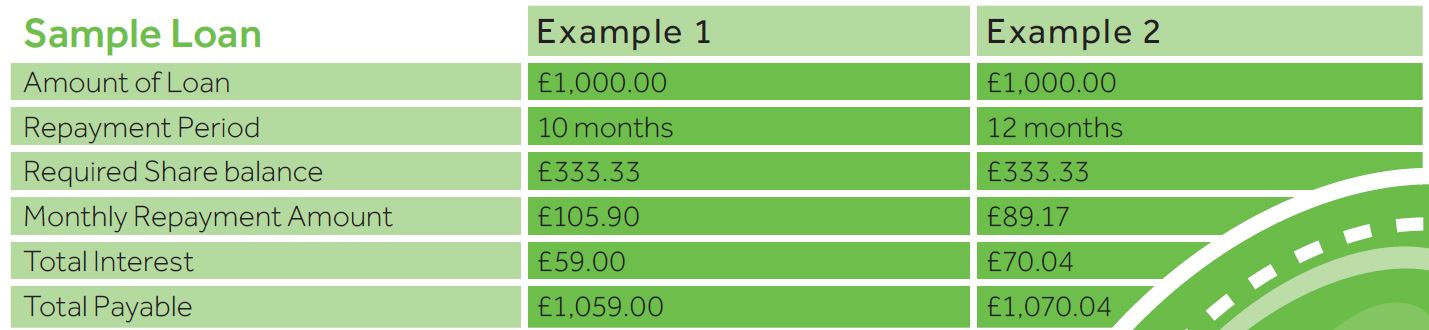

Can you provide a sample loan illustration?

How does it work?

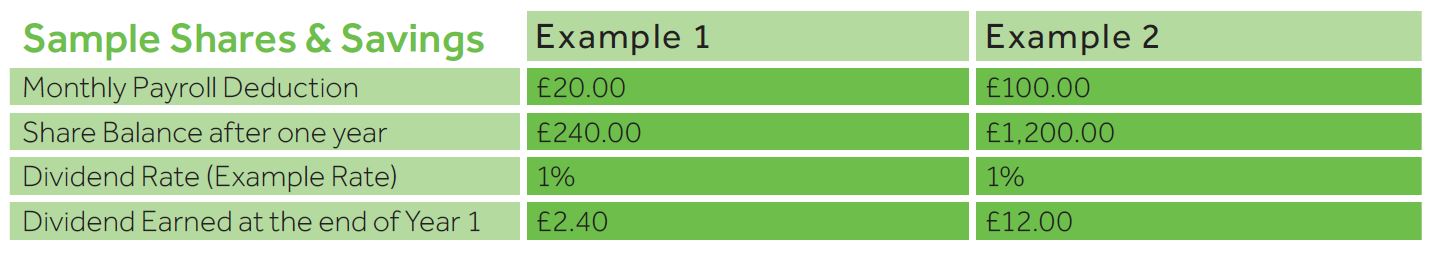

It’s very simple! After you have become a member, you can opt to have a designated amount deducted from your payroll each month. You decide how much so it is suitable for you. It can be as low as £20 per month. This amount is added to your share balance each month.

At the end of the year you will receive a small extra dividend on top of your share balance.

How can I save using the credit union?

Our Credit union savings offers an annual dividend rate to top up your share balance. The dividend rate depends on how well the credit union does that year – so you don’t know what you’ll get until the end of the year.

Question: Why should credit unions PAY YOU dividends or interest on money you deposit with them?

Answer: Because, they earn interest on using your money as loans for other members.

Can you provide a sample savings illustration?

Is a credit union savings account for you?

A credit union savings account might be for you if:

- You want a flexible account that lets you save what you can, when you can

- You like the idea of saving with an organisation owned by and run for the members that use its services

- You’ve had difficulty opening an account with a bank or building society

Want even better news?

- You can continue to benefit from the Credit Union even after you have left the Secretariat

- Your spouse can join the Credit Union to double up on your savings

Are my savings protected?

The Commonwealth Secretariat Staff Credit Union is regulated by the Financial Services Act. It is collectively owned by its members, all of whom are shareholders. Authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (UK).

How do you become a member?

Membership of the Credit Union is open to all permanent employees of the Commonwealth Secretariat and other approved Commonwealth bodies, ex-employees who were Credit Union members at the time of leaving, and spouses of current members of the Credit Union.

There is a one-off enrolment/administrative fee of £5.00 for new members. To join, please complete our new membership form here or send an email to creditunion@commonwealth.int .